UAE Gratuity Calculator Tool

Accurate, proration-aware & exportable results (UAE rules default)

UAE Gratuity Calculator – Your EOSB Partner

If you want to calculate your gratuity or end-of-service benefit based on years of service and basic salary, then this is the best and official platform.

This UAE gratuity calculator gives you an exact estimate of your gratuity amount – no matter if you work in Dubai, Abu Dhabi, Sharjah, or any other emirate.

Just enter your joining date, last working date, and basic salary into this gratuity calculator online, and you’ll get your result within seconds.

The system is based on the latest MOHRE gratuity calculator formula, ensuring that users receive accurate and reliable results for their end of service benefits. It is the most trusted EOSB calculator UAE available.

For a complete settlement calculator UAE experience that covers all your dues, this is the perfect tool.

What is Gratuity?

Gratuity is basically a “Thank you” payment that an employer gives to an employee when they leave a job or retire.

It’s a mandatory end-of-service benefit given to every eligible employee according to the UAE Labor Law.

In simple words – the more years you’ve served, the higher your gratuity amount will be.

How Our Gratuity Calculator UAE Works?

This online tool calculates your end-of-service benefits based on your basic salary, total years of service, and contract type. Users simply enter their joining date, last working date, and basic salary into this UAE gratuity calculator online, and the tool will generate the result instantly using the official MOHRE formula. It automatically calculates the difference between limited and unlimited contracts, giving the user an accurate result. Within seconds, the user receives the exact gratuity amount as per the latest UAE Labor Law. It is the fastest way to calculate gratuity online.

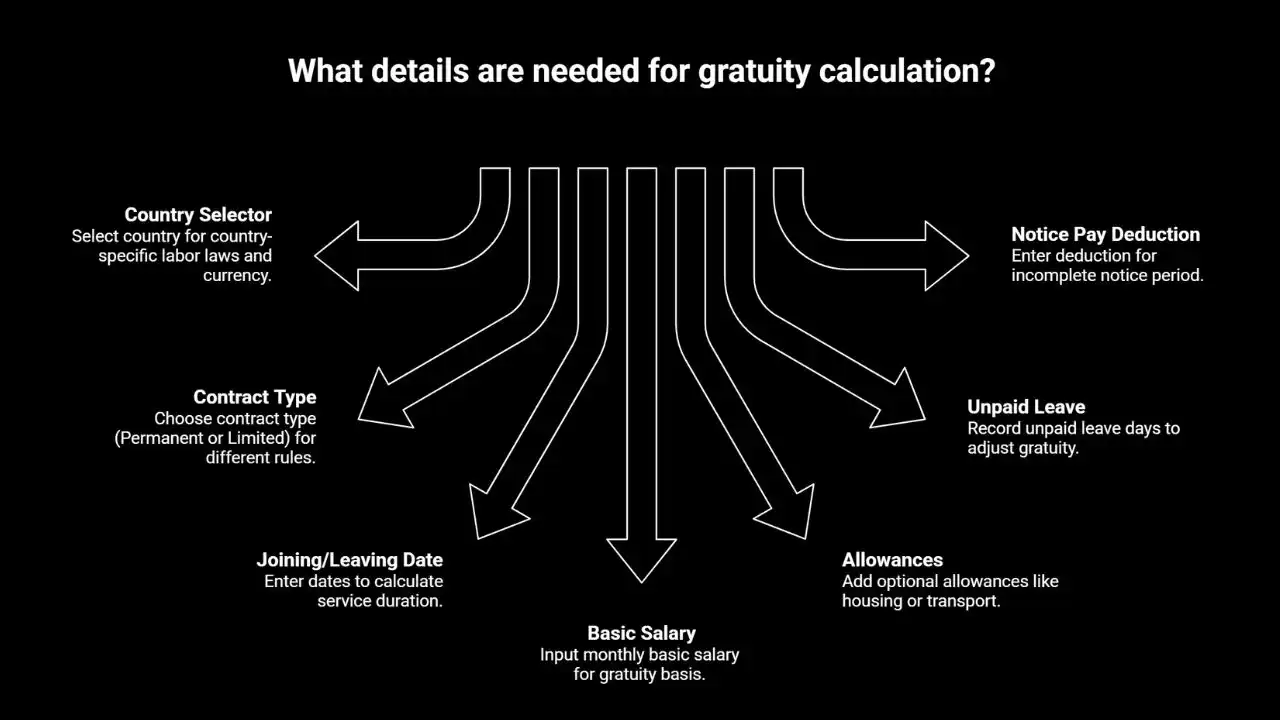

Calculator Function Explanation

1. Country Selector:

The user selects their country here so that the calculator will return results in accordance with that country’s labor laws. Currency (AED or INR) automatically updates based on the selected country.

2. Contract Type:

This option allows the user to select their contract, such as Permanent or Limited, as the rules for both are different.

3. Joining / Leaving Date:

These dates are used to calculate the employee’s service duration. The total number of years from joining to leaving is calculated.

4. Basic Salary (Monthly):

The employee’s monthly basic salary, which is an important basis for gratuity calculation.

5. Allowances (Monthly):

Housing, transport, or any other extra benefits are optional and can be added to the total salary.

6. Unpaid Leave Days:

A record of days for which the employee did not receive payment is adjusted against gratuity.

7. Notice Pay Deduction:

If the employee did not complete the notice period, the deduction for the same is mentioned here.

Just enter these 7 details, and the system will automatically show your result according to MOHRE rules

كيفية حساب مكافأة نهاية الخدمة في الإمارات؟

End-of-service benefits in the UAE calculate by using the basic salary and total completed years of service. The formula applies 21 days of basic pay for each year within the first five years of employment and 30 days of basic pay for every additional year. Only the basic salary enters the calculation, and all allowances remain excluded. The final amount prepares at contract completion, and payment issues after all employment procedures finish. This benefit provides financial compensation for the full period of service. READ MORE….

Gratuity Calculation Formula (According to UAE Labour Law)

Formula:

According to the UAE Labor Law, an employee is entitled to a gratuity if they have worked for one year or more. For the first five years, they receive 21 days of basic salary for each following year, and for those who exceed five years of service, they receive 30 days of salary for each following year. The formula is : (21 days’ basic salary × first 5 years) + (30 days’ basic salary × remaining years), This formula was established under Federal Decree-Law No. 33 of 2021.The maximum gratuity is capped at two years of total salary.

Example 1:

Country: UAE

Contract Type: Temporary

Joining Date: 01-01-2018

Leaving Date: 31-12-2023

Basic Salary: AED 6,000

Allowances: AED 2,000

Unpaid Leave: 10 days

Notice Deduction: 0

Example 2:

Country: UAE

Contract Type: Unlimited

Joining Date: 01-01-2018

Leaving Date: 31-12-2023

Basic Salary: AED 6,000

Allowances: AED 0

Unpaid Leave: 0 days

Notice Deduction: 0

Note: Gratuity is calculated only on basic salary and total service duration as per UAE labour law.

Calculate Gratuity by Zone or Authority

This site is not just a single calculator, it’s a complete and official end-of-service benefit (EOSB) calculator platform.

Dedicated tools are available for every authority and zone:

- MOHRE Gratuity Calculator

- Domestic Worker Calculator

- FreeZone

- DIFC Calculator

- JAFZA Calculator

- DMCC calculator

No matter if the user works in Dubai or Abu Dhabi, Sharjah , we have the perfect calculator for each and many other Emirates.

Emirate-Wise Gratuity Calculator

Apart from UAE, this gratuity calculator is also designed for Dubai, Abu Dhabi, Sharjah and many other cities – so that users can easily understand how their end-of-service benefits are calculated across the country.

Supporting Financial Tools

Not just gratuity, on this platform, user can also calculate:

- Leave Salary Calculator

- Annual Leave & Bonus Calculator

- Notice Period Pay

Why Choose Us

Our Gratuity Calculator provides 100% accurate and reliable results that comply with the latest labor laws across the UAE. No matter if you work in Dubai, Abu Dhabi, Sharjah, or anywhere in the region. This tool helps you calculate your End of Service Benefits in seconds. Our focus is on simplicity and clarity so that every user-No matter if a HR professional or an employee-can easily calculate gratuity. No complicated details, no hidden secrets-just a fast, clear, and professional solution you can trust.

- Fast & Accurate Calculation

- Covers All Emirates & Free Zones

- 100% Free & Updated with Latest Laws

- Mobile-Friendly, No Sign-up Needed

- Trusted by Professionals Across MENA